This can result in a better fairness place in your house when compared to a traditional home finance loan, supplying you with additional financial balance and potential borrowing electricity Down the road.

We've been committed to reinventing the house loan lending product so that you can deliver remarkable assistance, very low costs, and several of the fastest closing situations while in the business.

Acquiring down costs includes shelling out upfront factors, often called lower price points, to the lender. Just about every stage commonly expenses one% in the personal loan amount and can proficiently lessen the desire fee by a certain proportion for a particular period.

That might be silly, proper? Properly, that’s basically what’s happening whenever you buy a buydown on your property finance loan. In addition, you’ll save an entire good deal additional if you set that added cash toward your deposit as opposed to a buydown. Once you do this, you’ll wind up with much less whole curiosity

This balance will let you prevent any sudden money hardships and give you a perception of Manage over your economical situation.

Now you are aware of what exactly buydowns are all about. But we have to go over one more crucial issue: Should you get

home loan interest prices have gone the way in which of Elon Musk’s rockets (and so they’re little by little creating their way back down to Earth). So, to assist purchasers cope with These difficulties, some home loan lenders and sellers have gotten a bit Inventive and started pushing a thing named a

Upfront expenses: Long term buydowns require upfront charges to the client which can be important, dependant upon the amount of you “get down” your charge permanently. It’s important to talk to your mortgage lender to make sure the prospective financial savings outweigh the Original Value.

× The gives that look During this table are from partnerships from which Investopedia receives payment. This compensation could impact how and in which listings surface. Investopedia won't incorporate all provides available inside the marketplace.

Distinctive property finance loan products may perhaps offer you different advantages and drawbacks, and it’s essential to take a look at all readily available selections prior to making a choice.

Are you in the real estate market to purchase a home and on the lookout for approaches to save lots of on your own home mortgage payments? If that's so, you’ve come to the proper position! During this blog site submit, we’ll be discussing three-2-one buydowns, an intriguing option for property buyers.

In that condition, you’d get a discount on your home payments for 3 years without any extra fees or strings connected. That’s free of charge revenue! Aka a very superior deal. But when

On this scenario, the states represent the First many years within your property finance loan time period, and the price of fuel symbolizes the desire level on the financial loan.

Helping customers like you accomplish their economical aims is all we do, Which is the reason we’re arming you with our expert insight, suggestions, and tips that can 321 cash loans assist you get there.

Angus T. Jones Then & Now!

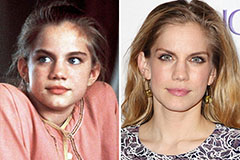

Angus T. Jones Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Jurnee Smollett Then & Now!

Jurnee Smollett Then & Now! Macaulay Culkin Then & Now!

Macaulay Culkin Then & Now! Nicholle Tom Then & Now!

Nicholle Tom Then & Now!